Partner with us to empower your students with essential financial knowledge and money management skills. Our enthusiastic team offers free, engaging lessons tailored to meet your students’ needs while aligning with state and national standards. Each lesson lasts 45 to 50 minutes but can be adjusted to fit your schedule.

Don’t miss this chance to enhance your student’s education!

Elementary School Lessons

- Wants Vs. Needs: In this lesson, students will participate in an engaging lesson about determining what is a want and what is a need.

- Earnie’s Grocery Store: Teach your students about shopping on a budget through this hands-on lesson! In this activity, students get to experience what it’s like to be an adult by planning out a days’ worth of meals for their family of 4 and then visit the “grocery store” to shop for their items. Depending on the age/skill level of your students, this activity can be tailored to include lessons about scarcity, wants vs. needs, savings, and more.

- My First Business: Put your students’ creativity to the test in this interactive activity all about entrepreneurship and making money! Students will learn about what it means to be an entrepreneur before diving in to create their own business plan, complete with a name and what they do, who they service, and even what their jingle would be! *Optional: After the activity, students can pitch their business ideas to the rest of the class!

Middle School Lessons

- Money Personalities – In this 45-minute lesson, students will explore their personal attitudes towards money. They will then work as a group to gain a better understanding of how people with different money personalities can work together.

- The Budget Challenge – The perfect introduction to creating a spending plan, this presentation is an aged-down version of our Reality Fair. This in-classroom activity challenges students to make it through a month without running out of money. Students will pick from various professions, learn about NET vs. GROSS income, roll dice to determine if they have kids, and then get to decide what their expenses will look like.

High School Lessons

- Budgeting 101 – Aligned to both state and national standards, this presentation covers topics like creating a budget, setting SMART goals, and having a financial plan that aligns with your goals and values.

-

- The Credit System – Knowing your way around the credit system is helpful in many situations: buying a house, getting a loan, applying for a job, or even renting an apartment. In this lesson, students get to review mock credit reports and learn about the credit bureaus. They will also learn about the components of a credit score and what impacts it – positively or negatively.

-

- Intro to Lending – In this interactive lesson, students have the opportunity play the role of a loan shark with the goal being to make the most money off the loans they give people. Throughout this activity, students will learn about various types of loans, the importance of understanding loan terms, and the differences between good and predatory lenders.

Schedule a "Bite of Reality" event at your School or Organization!

Attention, Amazing Teachers! Get ready to transform your students’ understanding of money with our exciting “Bite of Reality” events! Imagine your students diving into real-world money smarts, mastering the essentials of budgeting for rent, groceries, and those pesky surprises life throws our way (hello, unexpected car repairs!)

This isn’t just another lesson; it’s a hands-on adventure that makes budgeting come alive! Let’s equip tomorrow’s leaders with the skills they need today! Schedule one today! Let’s make financial literacy a fun reality for your students!

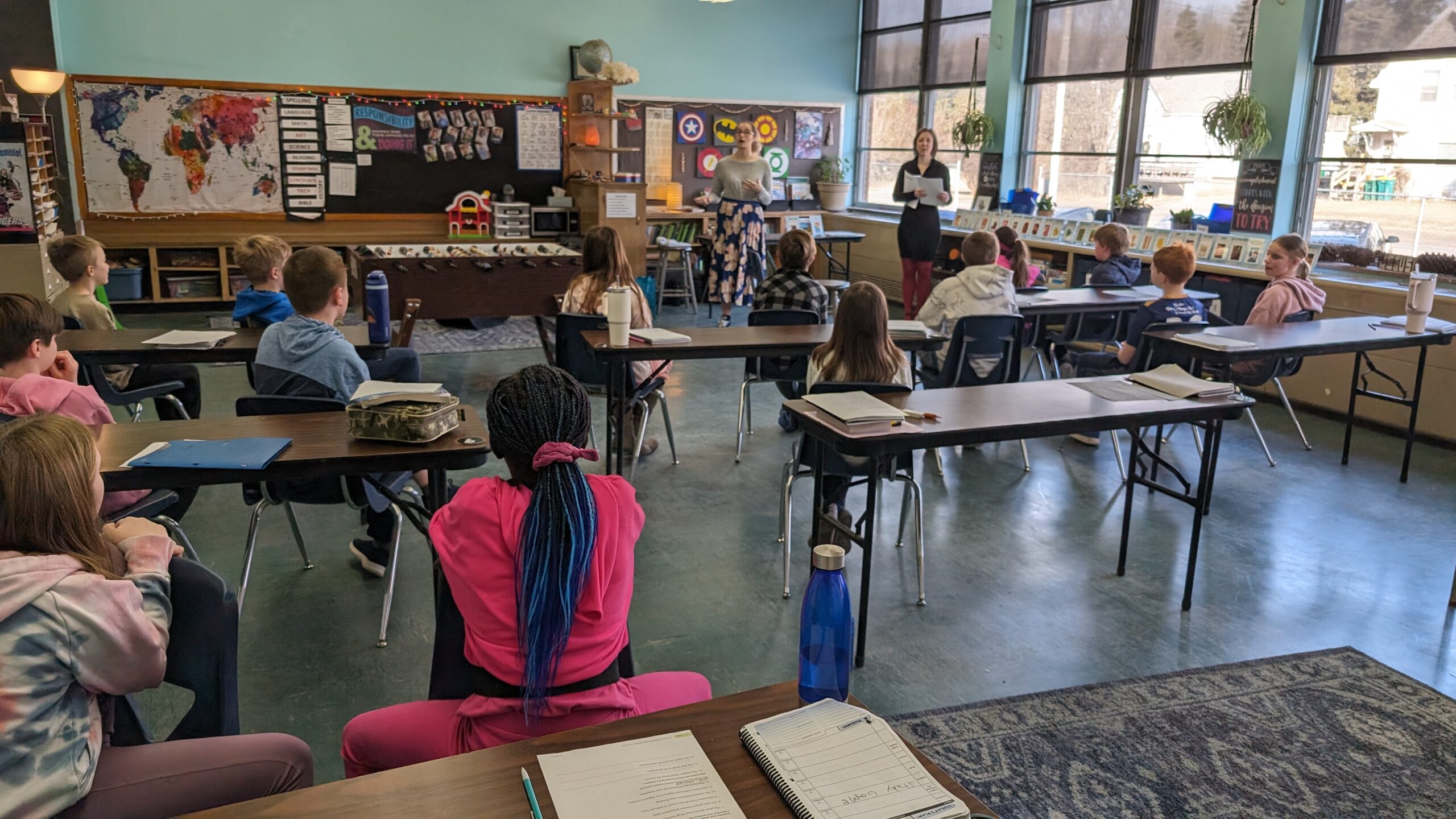

WATCH – Lakeview Christian Academy kids learn about budgeting at our “Bite of Reality” Fair

Teachers create your classroom using our Financial Wellness Center

Give us a call to learn more about the resources available to you!

Courses, Calculators, Assessments, and More!

Earning a Living

17 minutes

Financial Health

Buying a Home

Let us know how we can help YOU by completing the form below.

"*" indicates required fields