Northern Communities Retirement & Investment Services

Retirement and Investment Services for Members

Welcome to Northern Communities Credit Union’s Retirement and Investment Services. Planning for retirement is a crucial step towards ensuring a confident future. Our services are designed to help you navigate the complexities of retirement planning, from selecting appropriate accounts to building a diversified investment portfolio. Whether you’re just starting or nearing retirement, our goal is to provide you with the tools and knowledge needed to pursue your financial goals.

Meet Ed Grondahl

Experienced professional dedicated to you

As a credit union member, you have access to Ed Grondahl, our Financial Advisor at Northern Communities Retirement & Investment Services. If you are looking to balance, expand, or even begin your financial portfolio, Ed can work with you to plan and work towards your financial goals.

Contact Ed Grondahl

LPL Financial Advisor

(218) 591-6978 Cell

edward.grondahl@lpl.com

Contact Ed Today!

Our Services

401(k) Planning

Life Insurance

Long Term Care Insurance

Retirement Planning

Retirement Accounts

Education Planning

Tax Advantage Planning

Legacy Planning

Wealth Preservation

Check the background of this investment professional on FINRA’S BrokerCheck.

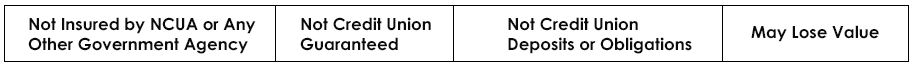

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Northern Communities Credit Union (NCCYou) and Northern Communities Retirement & Investment Services are not registered as broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Northern Communities Retirement & Investment Services and may also be employees of NCCYou. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, NCCYou or Northern Communities Retirement & Investment Services. Securities and insurance offered through LPL or its affiliates are:

Northern Communities Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services.

Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.